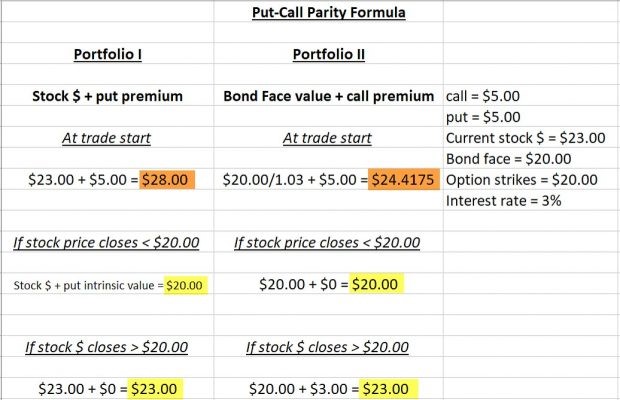

In put-call parity the Fiduciary Call is equal to Protective Put. Put yourself in someone elses shoes phrase.

Put Call Parity Arbitrage Opportunities

Put Call Parity

What Is The Put Call Parity Corporate Finance Institute

Put-call parity is an important concept in options Options.

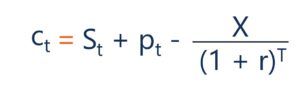

Put call parity. Early childhood educators call for pay parity. It states that the premium of a call option implies a certain fair price for the corresponding put option having the same strike price and expiration date. Fischer Black Myron Scholes and Robert Merton.

The most interesting feature of the Black-Scholes PDE 8 is that does not appear1 anywhere. So from the above example we can say that US Currency is overvalued than Britain and if the opposite the situation then there may be chances that opposite the things. Hence vertical spreads involve put and call combination where the expiry date is the same but the strike price is different.

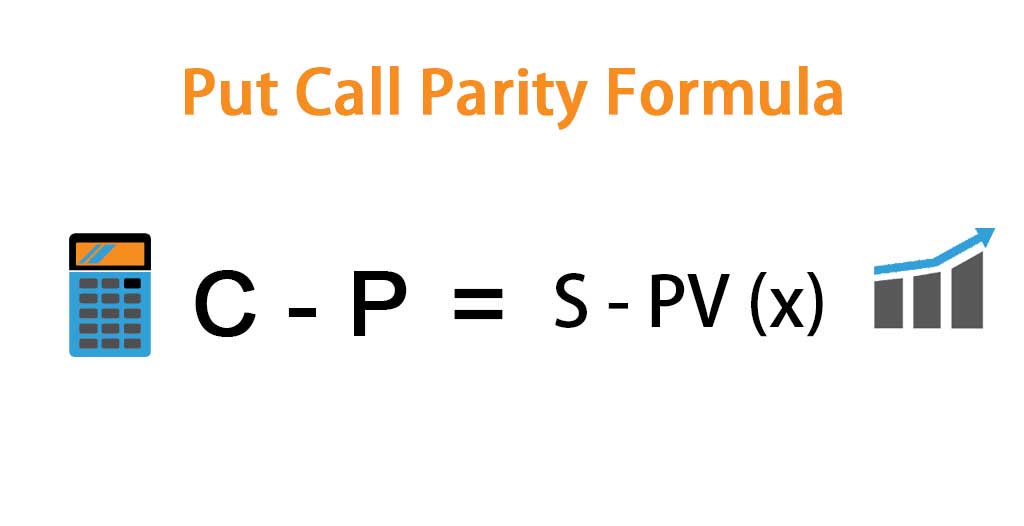

And the previous government had put a freeze. International Womens Day is a global day celebrating the social economic cultural and political achievements of women. Parity will be obtained when the differences between the price of call and the put option will be equal to the difference between the stocks current price and the current value of the strike price.

House-Senate negotiations on a compromise bill. Vertical Call and Put Spreads. The bull call spread requires a known initial outlay for an unknown eventual return.

Note that the Black-Scholes PDE would also hold if we had assumed that r. Outlook Looking for a rise in the underlying stocks price during the options term. 1 a commitment from the top 2 a clear plan of action that drives impact and 3 mutual accountability for measurable results.

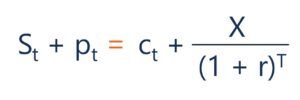

So called because options with the same expiry date are quoted on an options chain quote board vertically. Mick Fanning Steph Gilmore call to stop funding unless sports offer prizemoney parity. Put-Call parity equation can be used to determine the price of European call and put options.

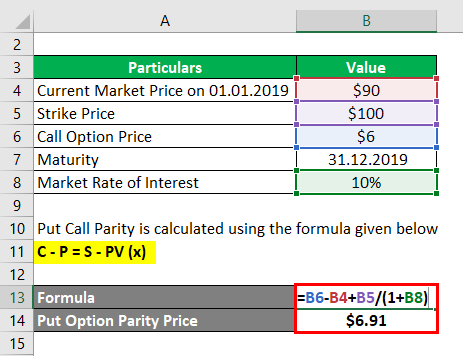

Louisa Steyl 1901 Nov 08 2021. Equation for put-call parity is C 0 Xe-rt P 0 S 0. The Paradigm for Parity coalition is comprised of business leaders board members and academics committed to addressing the corporate leadership gender gapThe coalition is differentiated by three factors.

Purchasing Power Parity 8 4. A call option often simply labeled a call is a contract between the buyer and the seller of the call option to exchange a security at a set price. Put-call parity is an important principle in options pricing first identified by Hans Stoll in his paper The Relation Between Put and Call Prices in 1969.

Put call parity concept establishes a relationship between the prices of European put options and calls options having the same strike prices expiry and underlying security. Significant activity is witnessed worldwide as groups come together to celebrate womens achievements or rally for womens equality. Formula to Calculate Purchasing Power Parity PPP Purchasing power parity refers to the exchange rate of two different currencies that are going to be in equilibrium and PPP formula can be calculated by multiplying the cost of a particular product or services with the first currency by the cost of the same goods or services in US dollars.

It states that the premium of a call option implies a certain fair price for the corresponding put option having the same strike price and expiration date. Equality especially of pay or position. Put-call parity is an important principle in options pricing first identified by Hans Stoll in his paper The Relation Between Put and Call Prices in 1969.

The bull put spread produces a known initial cash inflow in exchange for a possible outlay later on. The concepts outlined in the paper were groundbreaking and it came as no. Definition of put yourself in someone elses shoes in the Idioms Dictionary.

The Mental Health Parity and Addiction Equity Act MHPAEA of 2008 requires health insurers and group health plans that offer mental health and substance use disorder benefits to provide the same level of benefits for mental andor substance use treatment and services that they do for medicalsurgical care. Putcall parity is a static replication and thus requires minimal assumptions namely the existence of a forward contractIn the absence of traded forward contracts the forward contract can be replaced indeed itself replicated by the ability to buy the underlying asset and finance this by borrowing for fixed term eg borrowing bonds or conversely to borrow and sell. Purchasing Power Parity 2 So here the exchange rate between the US and Britain is 2.

Typically the put and call sides have the same spread width. Put-option can also now be easily computed from put-call parity and 9. The buyer of the call option has the right but not the obligation to buy an agreed quantity of a particular commodity or financial instrument the underlying from the seller of the option at a certain time the expiration date for a.

Paul Wellstone and Pete Domenici Mental Health Parity and Addiction Equity MHPAE Act signed into law by President George W. Bush as part of the Emergency Economic Stabilization Act of 2008 PL. Ngover Ihyembe-Nwankwo is currently the Head Coverage at Rand Merchant Bank Nigeria and the chairperson of the WIMBIZ Women in Management Business Public Service executive council where she is focused on deepening and re-enforcing their role as the catalyst that elevates the status and influence of women and their contribution to nation building.

House passes HR1424 by roll call vote 268 to 148. However if rthen investors would not demand a premium for holding the stock. Equality especially of pay or position.

What does put yourself in someone elses shoes expression mean. The Black-Scholes Model was developed by three academics. Put-Call Parity does not hold true for the American option as an American option can be exercised at any time prior to its expiry.

This trading strategy earns a net premium on the structure and is designed to take advantage of a stock experiencing low volatility. The day also marks a call to action for accelerating gender parity. Just 20000 signatures could be all thats needed to help close the.

Put-Call Parity Put-Call Parity Put-call parity is an important concept in options pricing which shows how the prices of puts calls and the underlying asset must be consistent with one another. This equation establishes a relationship between the price of a call and put. Put-call parity is the relationship between the price of European put and call options with the same underlying asset strike price and expiration.

It was 28-year old Black who first had the idea in 1969 and in 1973 Fischer and Scholes published the first draft of the now famous paper The Pricing of Options and Corporate Liabilities. Parity Policy and Implementation. Examples include bullbear callput spreads as discussed below and backspreads discussed separately.

As part of the unions National Day of Action for pay parity. Equal Pay for Equal Play. Definitions by the largest Idiom Dictionary.

Calls and Puts An option is a derivative contract that gives the holder the right but not the obligation to buy or sell an asset by a certain date at a specified price. Pricing which shows how the prices of puts Put Option A put option is an option contract that gives the buyer the right but not the obligation to sell the.

Put Call Parity For Futures Options Derivation In Hull Quantitative Finance Stack Exchange

Put Call Parity Formula How To Calculate Put Call Parity

Put Call Parity Video Khan Academy

Put Call Parity Formula How To Calculate Put Call Parity

Put Call Parity Equations And Formula

What Is The Put Call Parity Corporate Finance Institute

Put Call Parity In Python Investing Com India

Options On Stock Indices Currencies And Futures Options